-

play_arrow

CRUSADE Channel Previews CRUSADE Preview-Call 844-527-8723 To Subscribe

Tech pulls stocks lower as bond yields continue upward march

Via AP News:

Technology companies led another broad sell-off on Wall Street Thursday as a spike in bond yields put more pressure on the market’s high-flying stocks.

The S&P 500 fell 1.3%, its third straight loss. The benchmark index, which briefly dipped into the red for the year, is on track for its third consecutive weekly loss. Just four days ago it notched its biggest gain since June. That market rally was driven by what now appears to be a brief pause in the recent, swift rise in bond yields, which in turn pushes up interest rates on loans for consumers and businesses.

The latest losses came as the yield on the 10-year Treasury rose sharply during a question-and-answer session with Federal Reserve Chair Jerome Powell during which Powell said inflation will likely pick up in the coming months. He cautioned that the increase will be temporary, and won’t be enough for the Fed to alter its low-interest rate policies.

The remarks, signaling a wait-and-see stance on the surge in bond yields, failed to ease investors’ concerns that stronger growth will lead to higher inflation, which unchecked can slow economic growth.

“You have a context where rates have moved quite rapidly the last few days, so the market is generally on edge and looking for more reassurance in the short term,” said Lisa Erickson, head of traditional investments at U.S. Bank Wealth Management.

The S&P 500 fell 51.25 points to 3,768.47. The Dow Jones Industrial Average lost 345.95 points, or 1.1%, to 30,924.14. The Nasdaq composite dropped 274.28 points, or 2.1%, to 12,723.47. The pullback knocked the tech-heavy index into the red for the year.

Small-company stocks fell even more. The Russell 2000 index of smaller companies gave up 60.87 points, or 2.8%, to 2,146.92.

As the economy reopens this spring and summer, and vaccines are distributed and the coronavirus retreats, many economists expect a spending boom that will stretch available supplies of goods and services. That will likely push up prices, Powell said Thursday.

Even so, Powell gave no hint that the Fed would take steps to keep longer-term interest rates in check, such as by shifting some of its $80 billion in monthly Treasury purchases to longer-term securities.

Read the rest of the article here

Click here to make a donation.

![]()

Click here to subscribe to The CRUSADE Channel’s Founders Pass Member Service. www.crusadechannel.com/go

What Is The Crusade Channel?

The CRUSADE Channel, The Last LIVE! Radio Station Standing begins our LIVE programming with our all original CRUSADE Channel News hosted by Janet Huxley. Coupled with Mike “The King Dude” Church entertaining you during your morning drive and Rick Barrett giving you the news of the day and the narrative that will follow during your lunch break!

We’ve interviewed over 200 guests, seen Brother Andre Marie notch his 200th broadcast of Reconquest; the The Mike Church Show over 1200 episodes; launched an original LIVE! News Service; written and produced 4 Feature Length original dramas including The Last Confession of Sherlock Holmes and set sail on the coolest radio product ever, the 5 Minute Mysteries series! We are the ONLY outlet to cover the Impeachment of President Trump from gavel to gavel!

Now that you have discovered The Crusade, get 30 days for FREE of our premium service just head to:

https://crusadechannel.com OR download our FREE app: https://apps.appmachine.com/theveritasradionetworkappIti-

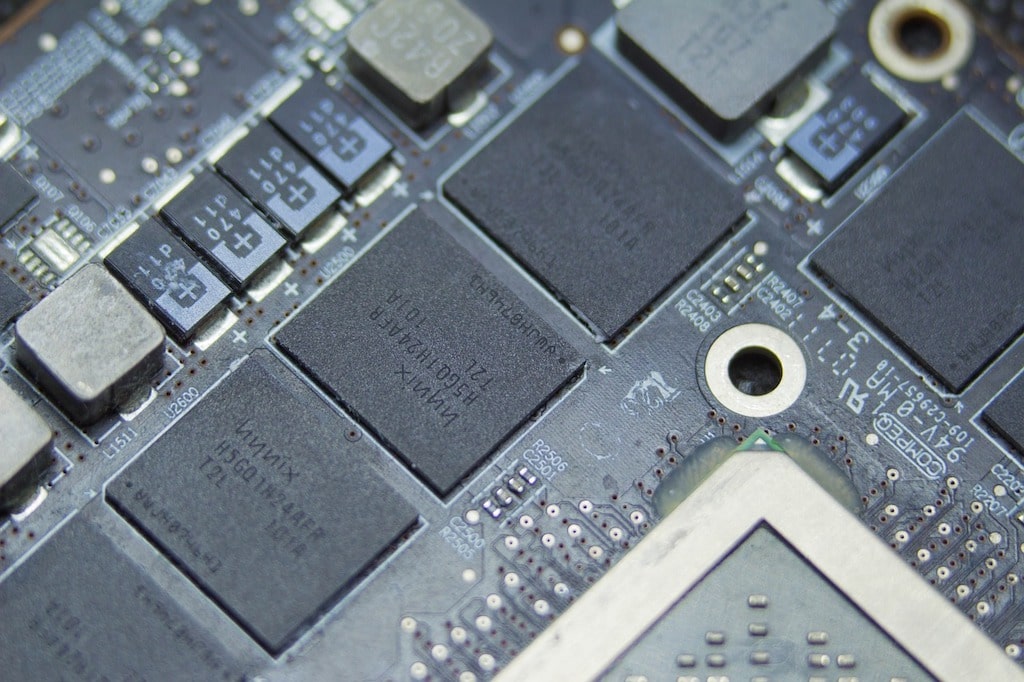

Did you know about Tech? If you are interested in supporting small business, be sure to check out the official store of the Crusade Channel, the Founders Tradin Post! Not to mention our amazing collection of DVD’s, Cigars, T-Shirts, bumper stickers and other unique selection of items selected by Mike Church!

Written by: LoneRhody

Similar posts

MCS #2324 – If Cuba is Next Will We Get the Cigars & Rum Too?

today03/06/2026 765 13

Copyright BlackHat Studios 2026 dba The CRUSADE Channel, All Rights Reserved

Post comments (0)